JPMorgan’s strategists saw a major breakthrough in institutional interest in BTC last December, and this seems to have led them to decide to create a new product that includes shares of major crypto investment companies.

Details of this J.P. Morgan Basket of Companies with Exposure to Cryptocurrency have been revealed in an official application to the SEC where we learn that this instrument brings 11 Reference Stocks of U.S.-listed companies.

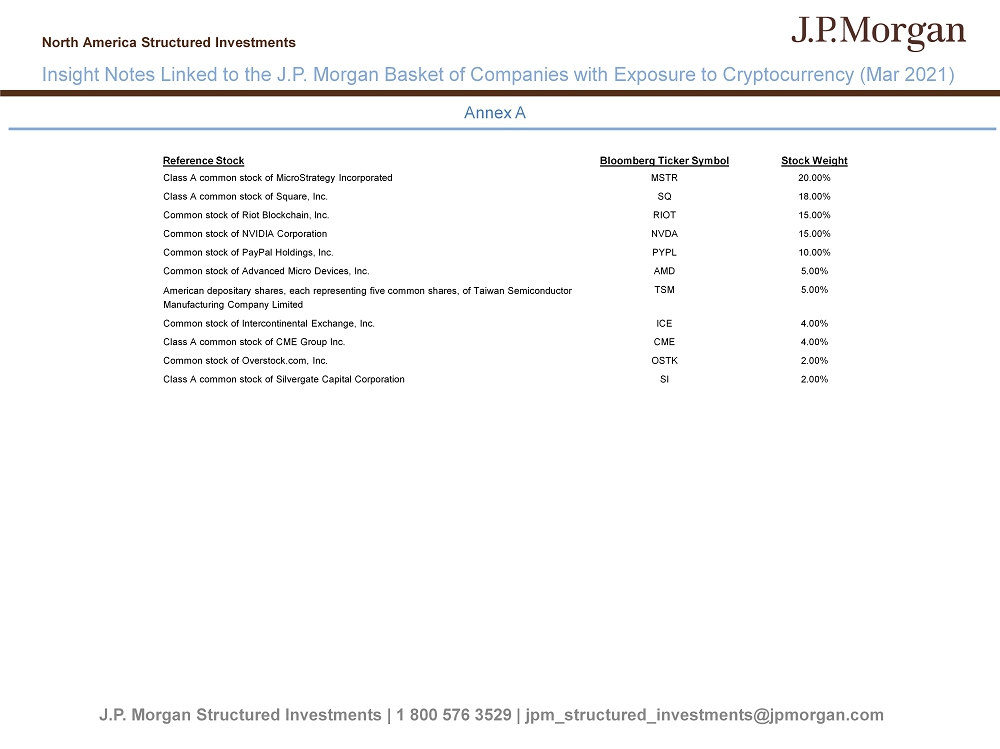

MicroStrategy has the largest share with 20%, followed by Square with 18%, Riot Blockchain with 15% but also NVIDIA with 15%. The contents of the basket did not forget about PayPal, which includes 10% of the company’s common stocks.

Below 10% of stock weight, there are companies such as Advanced Micro Devices, American depositary shares, representing five common shares of Taiwan Semiconductor Manufacturing Company Limited, Intercontinental Exchange, CME Group, Overstock.com but also Silvergate Capital Corporation.

Important notes include the minimum investment amount of $ 1000 due in May 2022, as well as the preliminary launch, which is set approximately for the end of this month.

Read also: Norwegian oil giant Aker establishes new subsidiary to invest in Bitcoin ecosystem